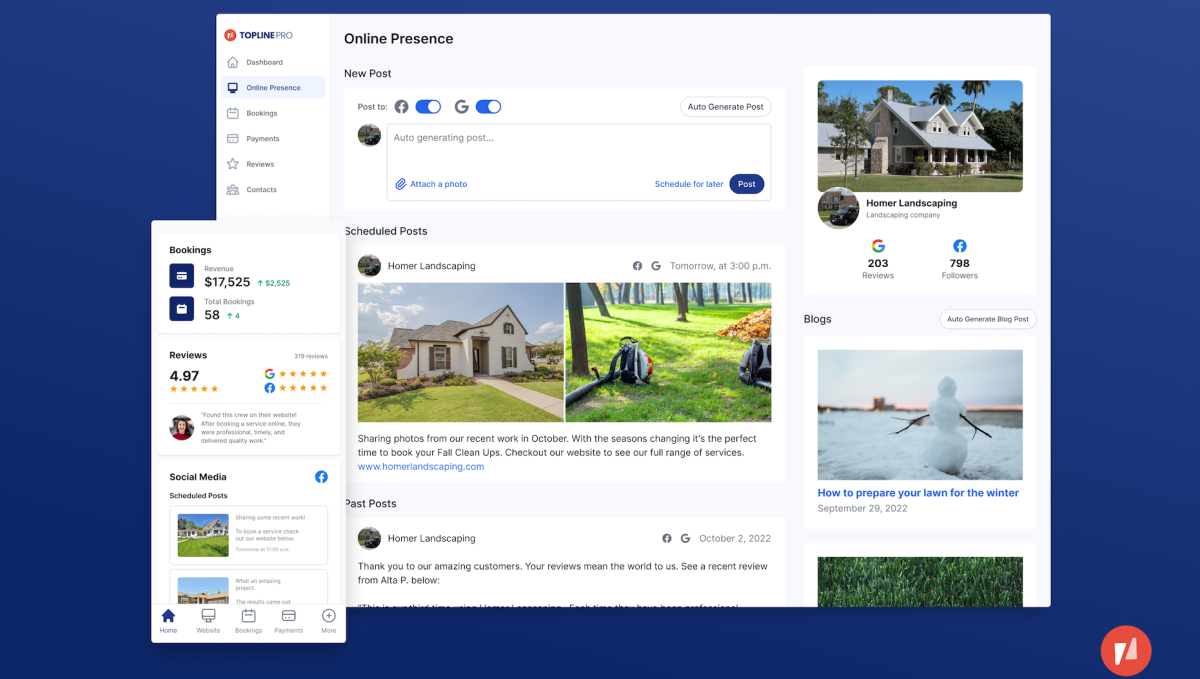

Like many “solopreneurs,” home service professionals have to balance doing the work while also managing a business. Topline Pro wants to take some of that burden off the shoulders of professionals so they can concentrate on customers. New York-based Topline Pro, formerly ProPhone, does this by leveraging generative artificial intelligence to provide a way for these businesses to get discovered, build trust among customers and generate repeat customers. The interface creates a custom website with search-engine optimization that can go live the same day. It showcases the professional’s business, including collecting online reviews, scheduling bookings and accepting payments. Meanwhile, the AI generates additional content, including local listings and automating social media content. Nick Ornitz, co-founder and CEO, started the company with Shannon Kay after meeting in business school. Inspiration for Topline Pro came from Ornitz’s siblings who are among the 5 million people running service-based companies, from landscaping to painting to cleaning and general contracting. In talking with them and home improvement retailers that he previously worked with, he and Kay realized just how much these businesses were relying on pen and paper. Topline Pro co-founders Shannon Kay and Nick Ornitz. Image Credits: Topline Pro “When you talk to a homeowner they were disappointed or frustrated by the experience and when you talk to the business owner, they’re trying their best to do the work, but also run the business,” Ornitz told ZebethMedia. “That just seemed like a really big opportunity.” Their initial idea, then called ProPhone, connected plumbers with homeowners over video chat. The co-founders even went through Y Combinator as part of the Winter 2021 batch. However, while accelerating the business, many of ProPhone’s plumber customers were saying that they like the video calls, but needed more jobs and they didn’t know how to grow their business beyond word-of-mouth. That’s when Ornitz and Kay pivoted to Topline Pro. They launched the current subscription product, which starts at $75 per month, in January of 2022. In 10 months, the company has generated more than $25 million in job requests across more than 1,000 monthly subscriber businesses in nearly all 50 states, Ornitz said. Topline is not alone in helping professionals manage their businesses digitally. In fact, this is becoming a hot area for startups to play in and for investors to flock. For example, in July, Finli, which developed a mobile-first payment management system for businesses, raised $6 million. Earlier this year, Zuper, a provider of productivity tools for field service management and customer engagement, raised $13 million. Before that, Fuzey raised $4.5 million in seed funding for its “digital one-stop shop” for small businesses and independent contractors, while Puls Technologies raised $15 million for its mobile app connecting tradespeople with on-demand home repair services. Ornitz says his company is different in a few ways, it is utilizing GPT-3 to automate unlimited multipage websites and administrative tasks. It is also not a marketplace and so its customers are able to be discovered directly by homeowners online so that they can own the relationships without that middle layer. Meanwhile, today Topline Pro announced $5 million in seed funding, led by Bonfire Ventures, and including TMV, BBG Ventures and a group of angel investors, like Squire co-founder Songe LaRon. Plans for the new capital include developing additional applications for the generative AI; for example, applications that help professionals with their SEO, content and blog updates as well as helping pros with their marketing. Ornitz also expects to add to the company’s 12 employees in the areas of engineering, product and customer success. “We want to make sure that the pro is being discovered by as many people as possible,” he added. “Once you’ve found that pro we want to make sure that the homeowner has an easier process to book with them and also pay with them. We know that word of mouth is still the strongest form of marketing, and we want to augment that.”