Mattilda wants to take over payment collection for Latin America’s private schools • ZebethMedia

Digital payments are gaining momentum in Latin America, and startups like Mexico-based mattilda are putting their spin on streamlining financial and administrative processes for private schools while also offering credit backed by future school fees.

The company was founded in 2022 by José Agote, Jesús Lanza, Juan Pablo Bravo, Adrián Garza and Ileana Gómez. Agote, Lanza and Bravo all previously worked together at Lottus Education, a university-focused educational platform in Mexico.

It’s forecasted that cashless payments in Latin America will double by 2030. Debit cards are used a majority of the time, with cash a close second, according to reports. Most schools accept bank transfers and debit card payments, but are not set up for those to be made other than by driving over to the school with a card in hand. Schools also do not have an easy way to see who was still missing payments, CEO Agote said.

It was while at Lottus that they saw how difficult it was for private schools to perform collections and get financing. In the United States, most private schools charge per semester. Parents can take out loans to pay for school in advance and the bank will assume the risk rather than the school. In Latin America, many of the payments are month to month, and if payment is not made, the school is the one to spend time contacting parents to collect that payment.

“There is a fault in the system with schools nowadays and they’re painfully aware of it,” Agote told ZebethMedia. “The main problem is that these collection cycles are much longer than what people expect.”

He explained what ends up happening is that, on average, 20% of the parents don’t pay by the due date and the school spends the next part of the month, if not more, trying to collect. For example, a school with 300 students will send 300 invoices then have to send out 300 follow-ups while also reconciling 300 payments each month.

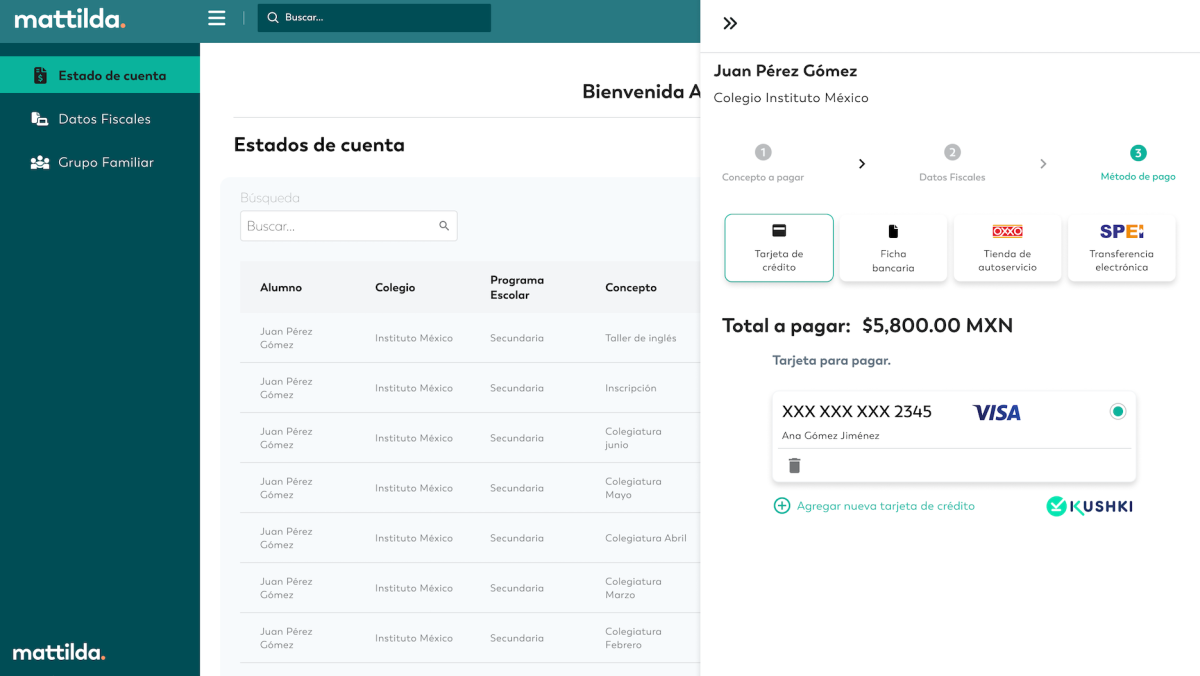

Here’s where mattilda comes in: the company provides a SaaS tool that enables parents to get a personalized payment link via email or WhatsApp and can then make tuition payments in a number of ways, including debit cards, credit cards, bank transfers and flexible credit lines, in seconds.

Mattilda also manages communication with students’ families while also offering a hub for parents to easily access relevant documents and information pertaining to payments. In addition, it offers loans to schools based on their future school fees.

“It’s hard for schools to get loans because banks will never execute on those assets,” Agote said. “There’s a lot of opportunity for investment in education, and no one is providing capital to these institutions, or if they are, they’re charging ridiculous rates like 30%.”

Rather, Agote said mattilda is comfortable advancing the tuition payments, which means the company takes on the risk if payment is not made, but gets compensated through the advancement when they do. It is also charging cheaper lending rates, around 18% to 20%, than the banks. In addition, the company makes money on the receivables, which it buys for below face value, he added.

So far, mattilda is working with 17 schools accounting for some 9,000 students, which Agote said will become 24 schools and close to 14,000 students as of November 1. Schools using mattilda average an 85% collection rate, versus the market standard rate of 70%, which he attributed to the removal of barriers to make the payment.

Helping private schools with their payments is an area where startups are blooming across Latin America. Earlier this month, we reported on Argentina-based Fidu, which raised $5 million and is working with 1,000 schools. Its approach, as Natasha Mascarenhas reported, is to “build a new operating system for LatAm schools so that institutions can digitally manage everything from finances to school-wide announcements.”

The company is also the latest to secure capital, raising $10 million in seed funding led by FinTech Collective. Also participating in the round was a group of investors including DILA Capital, QED Investors, GSV Ventures, Picus Capital, Emerge Education, SMP and Xochi Ventures.

Carlos Alonso-Torras, head of emerging markets at FinTech Collective, told ZebethMedia via email that he heard about mattilda through an angel investor friend that had been one of the first checks in.

What stood out to him initially was the “quality of the founding team.” He decided to invest when he saw how well the team was able to recruit some key hires and were responsive to recommendations on how to improve in skillset areas where they were weaker.

“On the back of Lottus Education’s success, they have a unique level of nuance in their understanding of the education space, and a powerful network that can result in partnerships conducive to hyper scaling in Spanish-speaking Latin America — several are already in place,” Alonso-Torras said. “Furthermore, they are very knowledgeable of the higher education space, which opens a frontier, so to speak, that other models in LatAm within this vertical haven’t successfully tapped into yet.”

Mattilda intends to deploy the new funds into expansion into other Spanish-speaking countries in Latin America, lending to schools and development of new products.

Agote said there are more than 5 million students in Mexico accounting for $15 billion in tuition, so the company has a long way to go as it works to target over 30,000 schools. There are also plans for creating a marketplace so schools can find better prices for items like laptops, uniforms lab and sports equipment and even desks and blackboards.

“We’re still scratching the surface in terms of penetration in Mexico and the marketplace,” he added. “We have those two different verticals we are targeting for the future of the company, and I think we can pursue both at the same time.”