Fundraising beyond the Bay Area, web3 gaming, TDD prep checklist • ZebethMedia

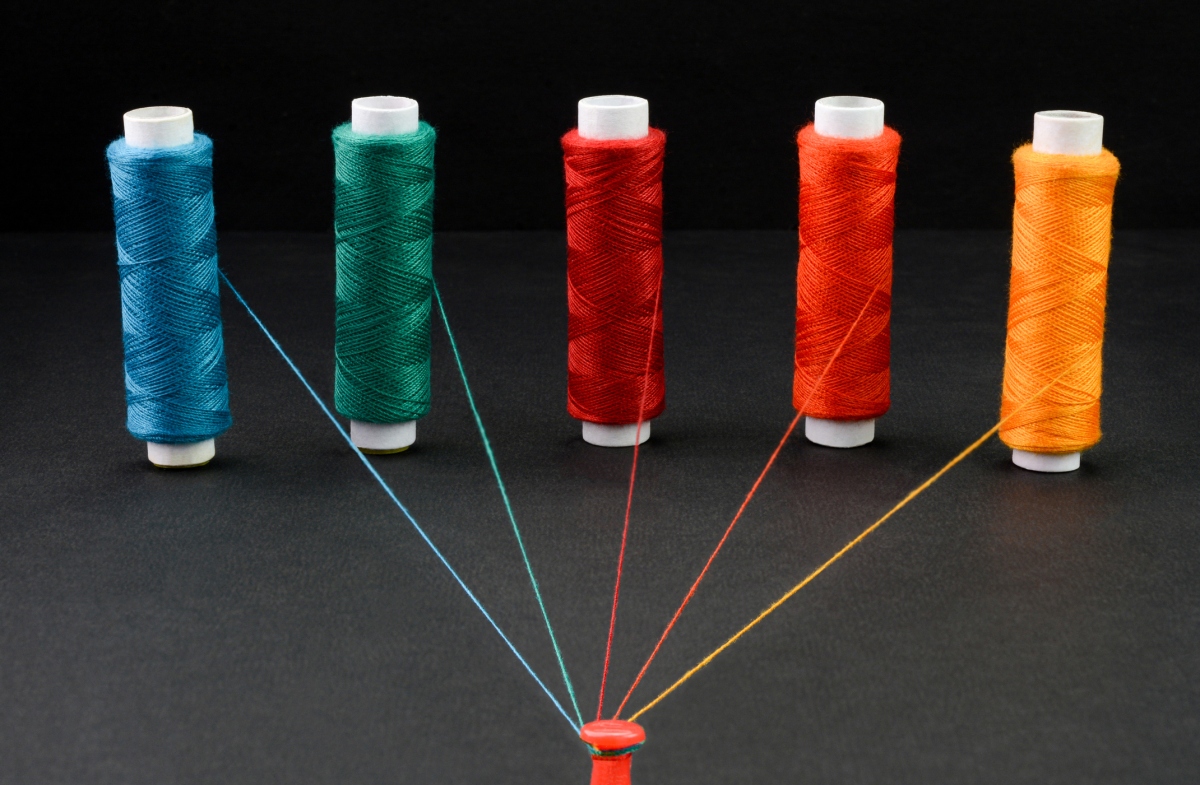

In a previous era, aspiring journalists relocated to New York, would-be actors made pilgrimages to Hollywood, and plucky tech founders moved to the Bay Area so they could attract capital and talent. But San Francisco is no longer the center of the startup universe, and it hasn’t been for a while. Cities like Boulder, Detroit and Austin had emerging tech ecosystems long before the pandemic forced VCs to start taking pitches via Zoom, and social media has leveled the playing field when it comes to networking and PR. Full ZebethMedia+ articles are only available to membersUse discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription “We noticed a couple of years ago, in looking at our own analytics, that most of our deals were coming through Twitter,” said Elizabeth Yin, co-founder and general partner of Hustle Fund, last week at ZebethMedia Disrupt. “If I look at my portfolio, my companies that are active on Twitter actually do have an easier time raising money because investors feel like they know them.” Reporter Dominic-Madori Davis moderated a discussion with Yin, Mike Asem (founding partner of M25), and Accel partner Rich Wong that elicited suggestions for early-stage founders who don’t live in the 415 area code and spilled the tea about “the emerging markets on their radars.” If you’re interested in the entire conversation, there’s a link to a video at the end of the article. Keep an eye out for more recaps from TC Disrupt in the coming days. Thanks for reading, Walter ThompsonEditorial Manager, ZebethMedia+@yourprotagonist 5 tips for launching in a crowded web3 gaming market Image Credits: Chelsea Sampson (opens in a new window) / Getty Images Every online product requires some network effect, but gaming is unique: Without large, loyal and enthusiastic customers, there’s no way to build products that can be monetized. Play-to-earn games (P2E) are particularly susceptible to this problem, which is why “building a game that succeeds in the long term means developing monetization strategies that can weather market ebbs and flows,” says Corey Wilton, co-founder and CEO of Mirai Labs, the gaming studio behind Pegaxy. In this primer for P2E founders, Wilton shares suggestions for how to approach investors, explains why tokens are not a reliable fundraising vehicle and discusses the recent “shift toward Web 2.0 monetization.” A prep checklist for startups about to undergo technical due diligence Image Credits: Pixelimage (opens in a new window) / Getty Images On Tuesday, founder and CEO of codebase analytics company Sema, Matt Van Itallie, shared a guest post for founding teams who are about to begin technical due diligence before an investment or acquisition. On Wednesday, he followed up with a detailed checklist for C-level executives and senior managers responsible for helping VCs determine whether their “codebase is safe enough for investment.” Product roadmap Code quality Code, network and information security Intellectual property Development process Engineering team contributions DevOps Pitch Deck Teardown: The Palau Project’s $125k pre-seed deck Image Credits: Palau Project (opens in a new window) Fundraising takes many forms, but because pre-seed founders are so often coaxing money from family and friends to validate their ideas, it can raise the emotional stakes. To raise money for The Palau Project, an app that lets users find the environmental impact and nutritional benefits of packaged food, founder Jerome Cloetens put together a 22-slide deck with a $500,000 goal. In the end, the team raised just $125,000. Dear Sophie: How can early-stage startups improve their chances of getting H-1Bs? Image Credits: Bryce Durbin/ZebethMedia Dear Sophie, We have a stealth early-stage biotech startup. Do we qualify to petition a co-founder on STEM OPT for an H-1B in the lottery? Is it worth it or are there better alternatives? — Budding Biotech 3 VCs explain how founders can stand out when pitching Image Credits: Kelly Sullivan (opens in a new window) / Getty Images There’s a lot of wisdom in corny motivational writing. For instance, this quote by Will Durant, a historian and philosopher: We are what we repeatedly do. Excellence, then, is not an act, but a habit. A great pitch requires more than charm and storytelling skills: investors expect founders to understand their market and competitors, and help them prepare before the meeting begins. “I generally recommend having almost like a teaser version of the deck with enough data and information to give us a sense of where you are in terms of the journey of your company,” said Jomayra Herrera, a partner at Reach Capital. “Just enough information so that we come prepared to the meeting.” 5 ways biotech startups can mitigate risk to grow sustainably in the long run Image Credits: jayk7 (opens in a new window) / Getty Images Thanks to R&D and clinical trials, life science startups have long lead times before they can bring their capital-intensive products to market. “But,” asks Omar Khalil, a partner at Santé Ventures, “what happens when the funding suddenly dries up?” In a guest post for TC+, he shares five strategies for biotech startups that are trying to stay warm through the winter ahead. “It’s still too early to know whether this is a short-term correction, or if it’s a new normal that will be maintained for the foreseeable future.”