Gravitics raises $20M to make the essential units for living and working in space • ZebethMedia

The space industry is on the cusp of a revolution. The cost of launch, which has dramatically decreased over the past five years, will continue to drop as heavy-lift rockets like SpaceX’s Starship and Relativity’s Terran R become operational. Parallel to these developments, multiple private companies have introduced plans to build commercial space stations for science, manufacturing and even tourism.

If space stations are the next phase of business in orbit, they’re going to need standard parts — and Gravitics aims to be the one making them. The startup is headed by space industry veteran Colin Doughan, who surveyed these currents and saw a gap in the market. Doughan’s career spans a nearly 20-year tenure at Lockheed Martin, where he worked as a senior finance manager dealing with large satellite constellations for government customers. He also co-founded Altius Space Machines, which was eventually purchased by Voyager Space in 2019.

Private station operators “are going to need an easy LEGO brick to build in space,” he told ZebethMedia in a recent interview: versatile, modular hardware to let humanity build in space at scale.

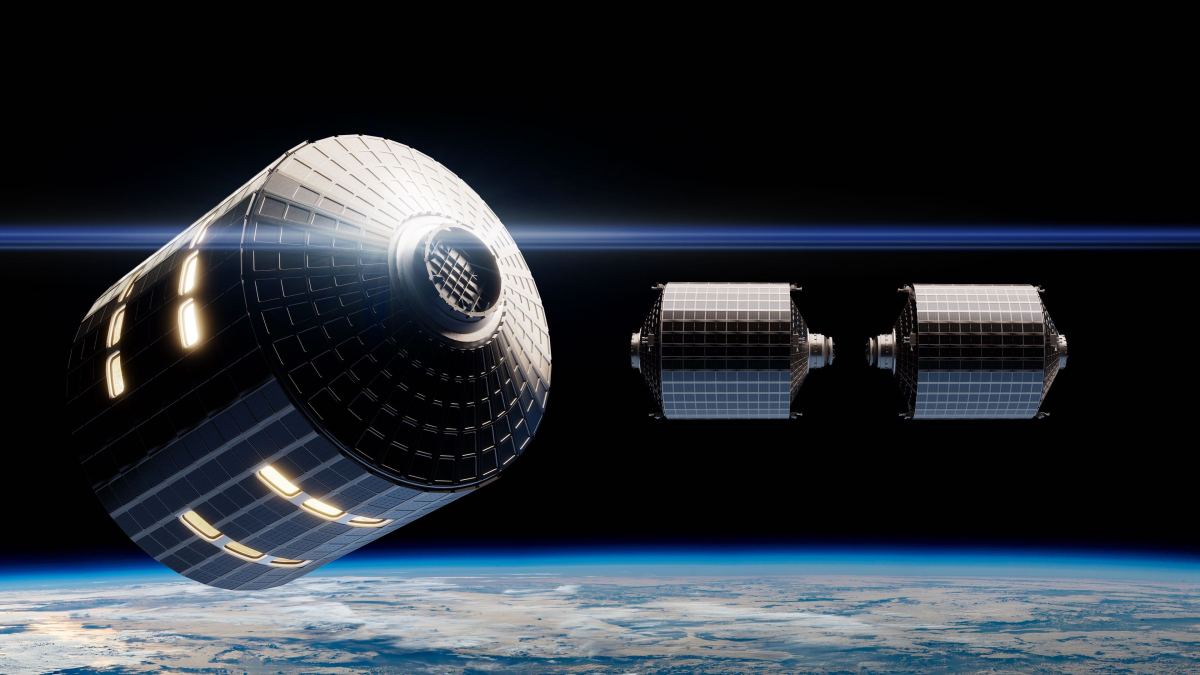

Gravitics, which emerged from stealth today following the announcement of a $20 million seed round, is calling the building block “StarMax.” (Doughan also refers to it as an SUV — a “Space Utility Vehicle.”) Notably, StarMax modules are huge: the model listed on the company’s website has a diameter of nearly 8 meters and an internal usable volume of 400 cubic meters, nearly half that of the International Space Station. Gravitics wants to position these modules as the essential base unit for living and working in space.

The initiative has caught investor attention in a major way, as the seed round illustrates — further proof that space station and in-space habitat plays are getting hotter. The funding was led by Type One Ventures, with additional participation from Tim Draper from Draper Associates, FJ Labs, The Venture Collective, Helios Capital, Chicago-based Giant Step Capital, Gaingels, Spectre, Manhattan West and Mana Ventures.

From an investor standpoint, Type One founding partner and Gravitics board member Tarek Waked said his firm noticed multiple underlying trends that support the company’s vision of the future.

“We’re betting on launch costs coming down. We’re betting on Starship revolutionizing the industry,” he said. It’s not just Starship’s cargo capacity that excites the Gravitics team. It’s the potential for the rocket to send up many more humans into space — people who, at present, would have nowhere to stay.

“There’s no infrastructure for those people to go [to], and even if we built that infrastructure today, there’s no modular or cost-effective way to get that much infrastructure up to orbit,” Waked said. “And that’s where I think Gravitics plays.”

StarMax at scale. Image Credits: Gravitics

Supplying the stations of the future

The specific play that Gravitics is making is emphatically not as a space station operator. Blue Origin and Sierra Space’s Orbital Reef, Voyager and Lockheed’s Starlab, and a third project headed by Northrop Grumman have already received major funding from NASA under the agency’s Commercial low Earth orbit Destinations (CLD) program. Rather than compete with these companies, Gravitics wants to be their core supplier.

Doughan said he anticipates a glut of demand for the product in the second half of the decade, as operators commence their initial build out. Beyond that, Gravitics is aiming to fulfill the ongoing needs of these stations once they are operational, plus meeting organic demand that the company is betting will emerge as costs for launching cargo and crew drop. StarMax will have power and propulsion onboard for delivery and docking (and indeed, the company landed Virgin Orbit’s former senior director of propulsion, Scott Macklin, as its director of engineering).

“What we’re guessing is going to happen is that station demand is going to grow,” Doughan said. “They’re going to need scalability over time.”

A rendering of an office on StarMax. Image Credits: Gravitics

What the economy in low Earth orbit will ultimately look like is anyone’s guess, however, and from the outside it seems that StarMax’s emphasis on scalability in the design (the module has docking ports on either end) is also a hedge against the space industry’s notoriously uncertain timelines. But it also makes sense from a market perspective: Gravitics is prepared to sell the StarMax module to entities that may want to use it in a free-flyer capacity, or an operator that wants flexibility on offering short-term stays or long-term attachments to the stations; but StarMaxes can also be daisy-chained to form even larger in-space platforms as more and more people spend time in space.

(opens in a new window)

“Of or pertaining to gravity”

For all the talk of Starship, the company isn’t putting all its eggs in that one, Musk-y basket. The suite of StarMax modules under development are being designed to be compatible on other next-gen launch vehicles, like United Launch Alliance’s Vulcan and Blue Origin’s New Glenn. While Gravitics is staying tight-lipped on how much a single StarMax might cost, Doughan said it would be competitive with a recent deal between Axiom Space and Thales Alenia for two station modules, a contract valued at €110 million ($108 million), or $54 million each.

The company recently opened a 42,000-square-foot facility just north of Seattle where it has already begun constructing prototypes and preparing for early module pressure tests early next year. Gravitics is also in talks with development groups in Florida about building a larger production and integration facility right next to their customer base at Kennedy Space Center. In addition to these physical spaces, the company will also use the funds from this seed round to continue growing its team. It has already attracted notable talent, like the aforementioned Macklin and Bill Tandy, former mission architect and chief engineer for Orbital Reef.

The pressure tests in the first quarter of next year are the initial step toward testing a StarMax in orbit, though Doughan declined to offer any details on that timeline. But it’s safe to say that the company is moving fast — as are all the companies hoping to operate the next generation of space stations — in the face of the impending decommissioning of the ISS at the end of the decade. NASA officials have been clear that they want no space station gap, and they’re willing to help fund ventures to ensure a strong American presence in orbit. To keep up with this pace, Gravitics is taking preorders now for delivery in 2026.

By now the company name must have struck you. Gravitic — according to some online dictionaries, it’s an archaic word meaning of or pertaining to gravity, one that’s mostly been replaced by the word gravitational. Doughan and Waked are adamant that the company is laser focused on meeting the needs of customers today with the zero G StarMax modules. But Doughan admits that the company’s true “north star,” as he put it, is gravitic solutions, with a lowercase “g”: space stations that recreate Earth’s gravity to enable a truly long-term human presence in orbit.

“If we’re going to truly make space our heritage, and really extend human flourishing through the solar system, gravitic solutions are really the only way that that’s going to happen. Although that’s not today, that continues to be the north star for the company.”