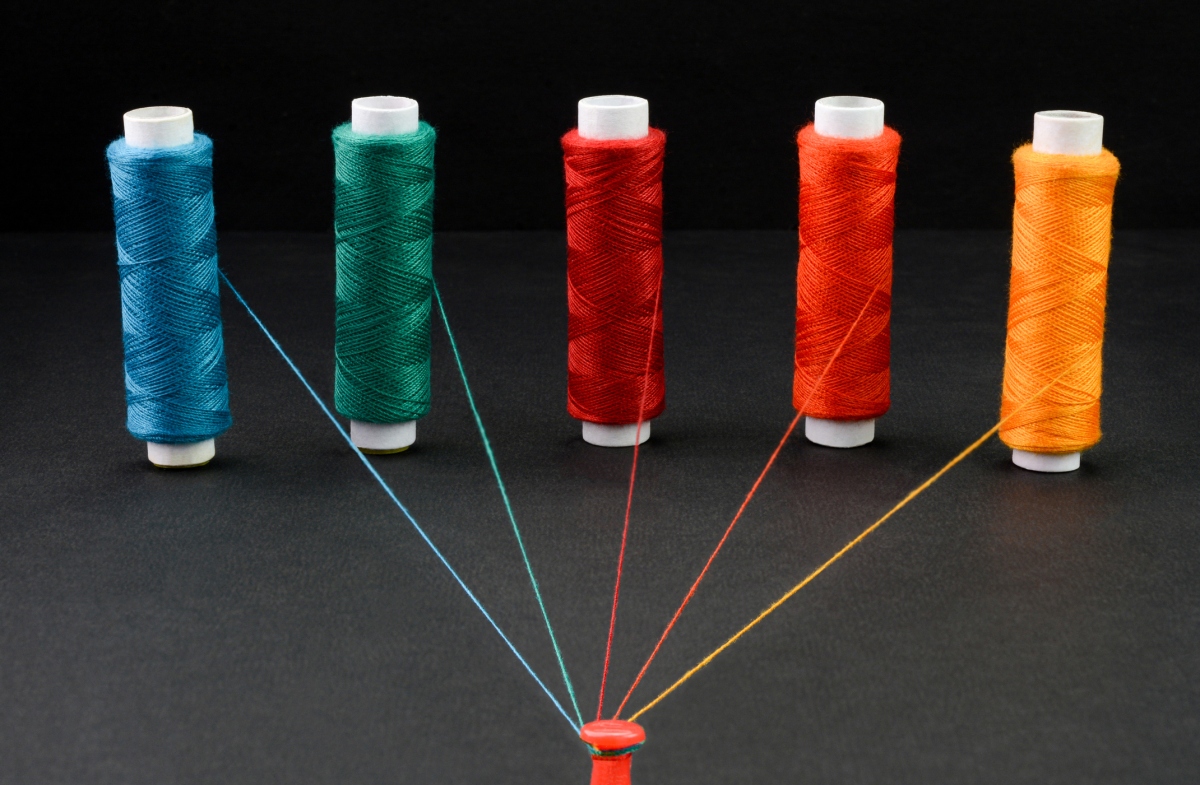

Stability AI, the venture-backed startup behind the text-to-image AI system Stable Diffusion, is funding a wide-ranging effort to apply AI to the frontiers of biotech. Called OpenBioML, the endeavor’s first projects will focus on machine learning based approaches to DNA sequencing, protein folding, and computational biochemistry. The company’s founders describe OpenBioML as an “open research laboratory” — aims to explore the intersection of AI and biology in a setting where students, professionals and researchers can participate and collaborate, according to Stability AI CEO Emad Mostaque. “OpenBioML is one of the independent research communities that Stability supports,” Mostaque told ZebethMedia in an email interview. “Stability looks to develop and democratize AI, and through OpenBioML, we see an opportunity to advance the state of the art in sciences, health and medicine.” Given the controversy surrounding Stable Diffusion — Stability AI’s AI system that generates art from text descriptions, similar to OpenAI’s DALL-E 2 — one might be understandably wary of Stability AI’s first venture into health care. The startup has taken a laissez-faire approach to governance, allowing developers to use the system however they wish, including for celebrity deepfakes and pornography. Stability AI’s ethically questionable decisions to date aside, machine learning in medicine is a minefield. While the tech has been successfully applied to diagnose conditions like skin and eye diseases, among others, research has shown that algorithms can develop biases leading to worse care for some patients. An April 2021 study, for example, found that statistical models used to predict suicide risk in mental health patients performed well for white and Asian patients but poorly for Black patients. OpenBioML is starting with safer territory, wisely. Its first projects are: BioLM, which seeks to apply natural language processing (NLP) techniques to the fields of computational biology and chemistry DNA-Diffusion, which aims to develop AI that can generate DNA sequences from text prompts LibreFold, which looks to increase access to AI protein structure prediction systems similar to DeepMind’s AlphaFold 2 Each project is led by independent researchers, but Stability AI is providing support in the form of access to its AWS-hosted cluster of over 5,000 Nvidia A100 GPUs to train the AI systems. According to Niccolò Zanichelli, a computer science undergraduate at the University of Parma and one of the lead researchers at OpenBioML, this will be enough processing power and storage to eventually train up to ten different AlphaFold 2-like systems in parallel. “A lot of computational biology research already leads to open-source releases. However, much of it happens at the level of a single lab and is therefore usually constrained by insufficient computational resources,” Zanichelli told ZebethMedia via email. “We want to change this by encouraging large-scale collaborations and, thanks to the support of Stability AI, back those collaborations with resources that only the largest industrial laboratories have access to.” Generating DNA sequences Of OpenBioML’s ongoing projects, DNA-Diffusion — led by pathology professor Luca Pinello’s lab at the Massachusetts General Hospital & Harvard Medical School — is perhaps the most ambitious. The goal is to use generative AI systems to learn and apply the rules of “regulatory” sequences of DNA, or segments of nucleic acid molecules that influence the expression of specific genes within an organism. Many diseases and disorders are the result of misregulated genes, but science has yet to discover a reliable process for identifying — much less changing — these regulatory sequences. DNA-Diffusion proposes using a type of AI system known as a diffusion model to generate cell-type-specific regulatory DNA sequences. Diffusion models — which underpin image generators like Stable Diffusion and OpenAI’s DALL-E 2 — create new data (e.g. DNA sequences) by learning how to destroy and recover many existing samples of data. As they’re fed the samples, the models get better at recovering all the data they had previously destroyed to generate new works. Image Credits: Stability AI “Diffusion has seen widespread success in multimodal generative models, and it is now starting to be applied to computational biology, for example for the generation of novel protein structures,” Zanichelli said. “With DNA-Diffusion, we’re now exploring its application to genomic sequences.” If all goes according to plan, the DNA-Diffusion project will produce a diffusion model that can generate regulatory DNA sequences from text instructions like “A sequence that will activate a gene to its maximum expression level in cell type X” and “A sequence that activates a gene in liver and heart, but not in brain.” Such a model could also help interpret the components of regulatory sequences, Zanichelli says — improving the scientific community’s understanding of the role of regulatory sequences in different diseases. It’s worth noting that this is largely theoretical. While preliminary research on applying diffusion to protein folding seems promising, it’s very early days, Zanichelli admits — hence the push to involve the wider AI community. Predicting protein structures OpenBioML’s LibreFold, while smaller in scope, is more likely to bear immediate fruit. The project seeks to arrive at a better understanding of machine learning systems that predict protein structures in addition to ways to improve them. As my colleague Devin Coldewey covered in his piece about DeepMind’s work on AlphaFold 2, AI systems that accurately predict protein shape are relatively new on the scene but transformative in terms of their potential. Proteins comprise sequences of amino acids that fold into shapes to accomplish different tasks within living organisms. The process of determining what shape an acids sequence will create was once an arduous, error-prone undertaking. AI systems like AlphaFold 2 changed that; thanks to them, over 98% of protein structures in the human body are known to science today, as well as hundreds of thousands of other structures in organisms like E. coli and yeast. Few groups have the engineering expertise and resources necessary to develop this kind of AI, though. DeepMind spent days training AlphaFold 2 on tensor processing units (TPUs), Google’s costly AI accelerator hardware. And acid sequence training data sets are often proprietary or released under non-commercial licenses. Proteins folding