The UserTesting sale to private equity is bad news for unicorns • ZebethMedia

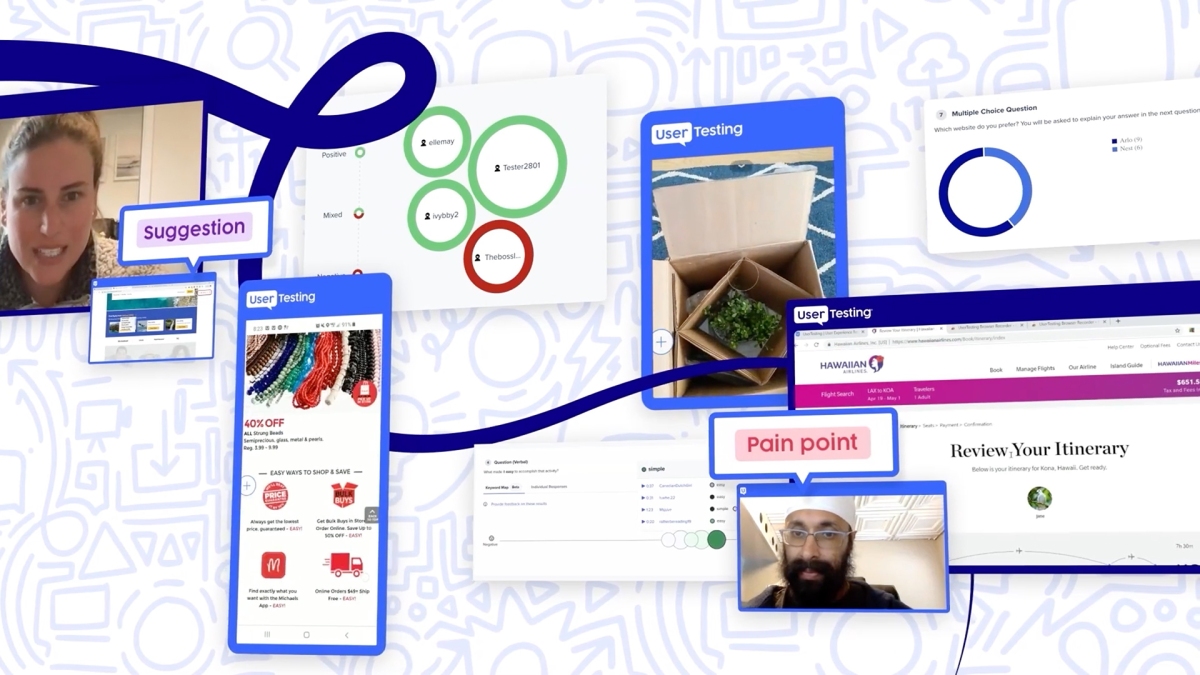

News broke this morning that UserTesting, a former startup that went public last year, is selling to private equity (Thoma Bravo, Sunstone Partners) for $1.3 billion, or $7.50 per share in cash. The deal, expected to close in the first half of 2023, does include a “go-shop” period, in case a better deal crops up. Holders of UserTesting shares have some cause for joy. The customer insight platform is selling for what it describes as a “premium of approximately 94% over [its] closing stock price” yesterday. As a result, shares of UserTesting soared today as investors digested the news. UserTesting dropped earnings this morning in conjunction with the deal news, giving us a window into its health. We can cross those numbers with the final price that UserTesting will command in the sale to improve our understanding of the value of smaller technology companies — at least when compared to the giants of their industry. The lessons thereof are pretty simple and not great for yet-private unicorns. Looking at the deal, it’s clear that single-digit SaaS multiples are not merely real but durable. UserTesting is exiting at a nearly 100% premium for a fraction of the price at which it went public last year. Unless the company is a financial mess, that’s terrifying for unicorns that raised money last year.