Manufacturing firm Bright Machines raises $132M after unfulfilled SPAC deal • ZebethMedia

In May of last year, Bright Machines announced plans to embrace the SPAC craze with a merger deal that valued the Bay Area-based manufacturing firm at $1.6 billion. As the temperatures for the phenomenon cooled, however, so too did its plans. The plug was pulled last December, a little over a month before it was planned to go through.

Even without the SPAC slowdown, it hasn’t exactly been the ideal economy for such a large deal.

Today, the company announced that it’s returned to the more tried and true method of fundraising with a combined $132 million raise — that’s $100 million in equity funding (led by founder Lior Susan’s own Eclipse Ventures) and $32 million in debt (co-led by Silicon Valley Bank and Hercules Capital). All told, the latest round brings the firm up to $330 million since its 2018 founding, when it arrived with a $179 million Series A.

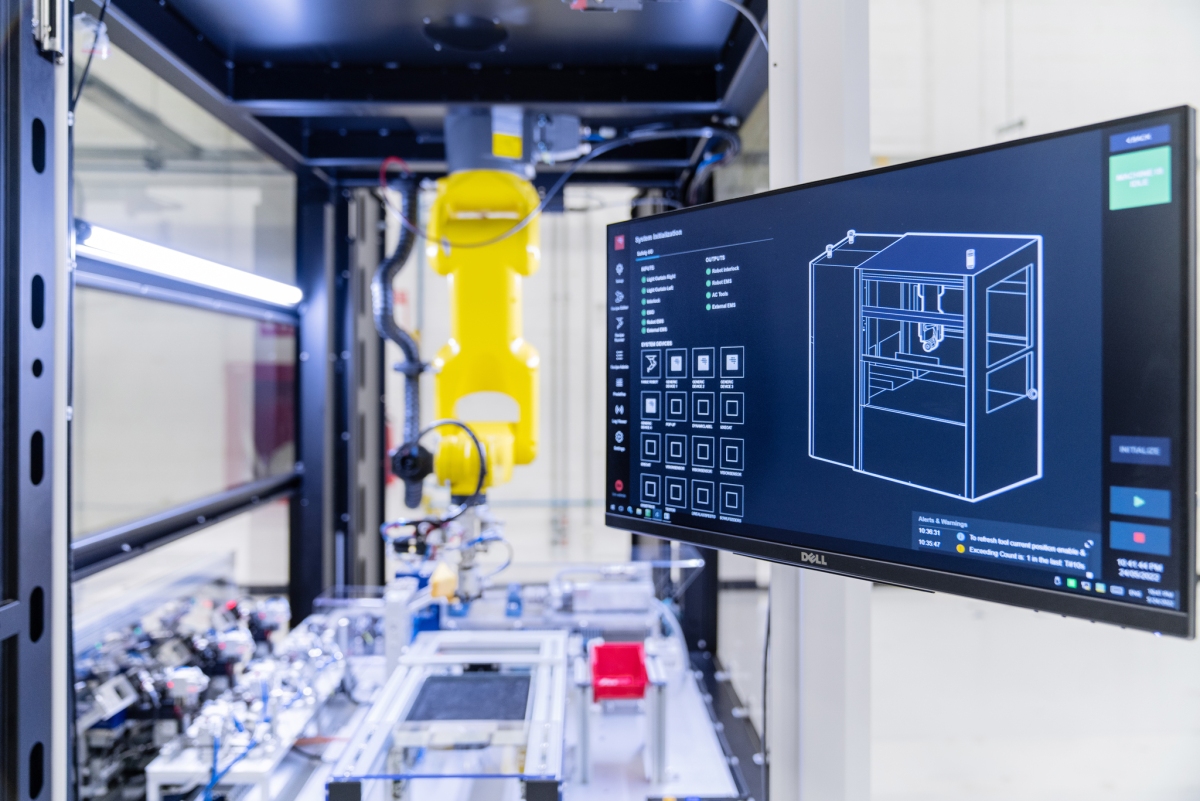

The funding comes as the U.S. has taken an aggressive approach toward reinvigorating domestic manufacturing, in part due to economic incentive bills like the CHIPS act. Firms like Intel have been investing billions to help diversify geographic semiconductor production. Bright Machines’ own vision is built around the concept of “micro factories” — software-driven production lines that rely on robotics and automation.

The company says it has deployed some 100 such micro factories across 13 countries since its founding. The latest funding will go toward accelerating its roadmap.