Coefficient wants to bring live data into your existing spreadsheets • ZebethMedia

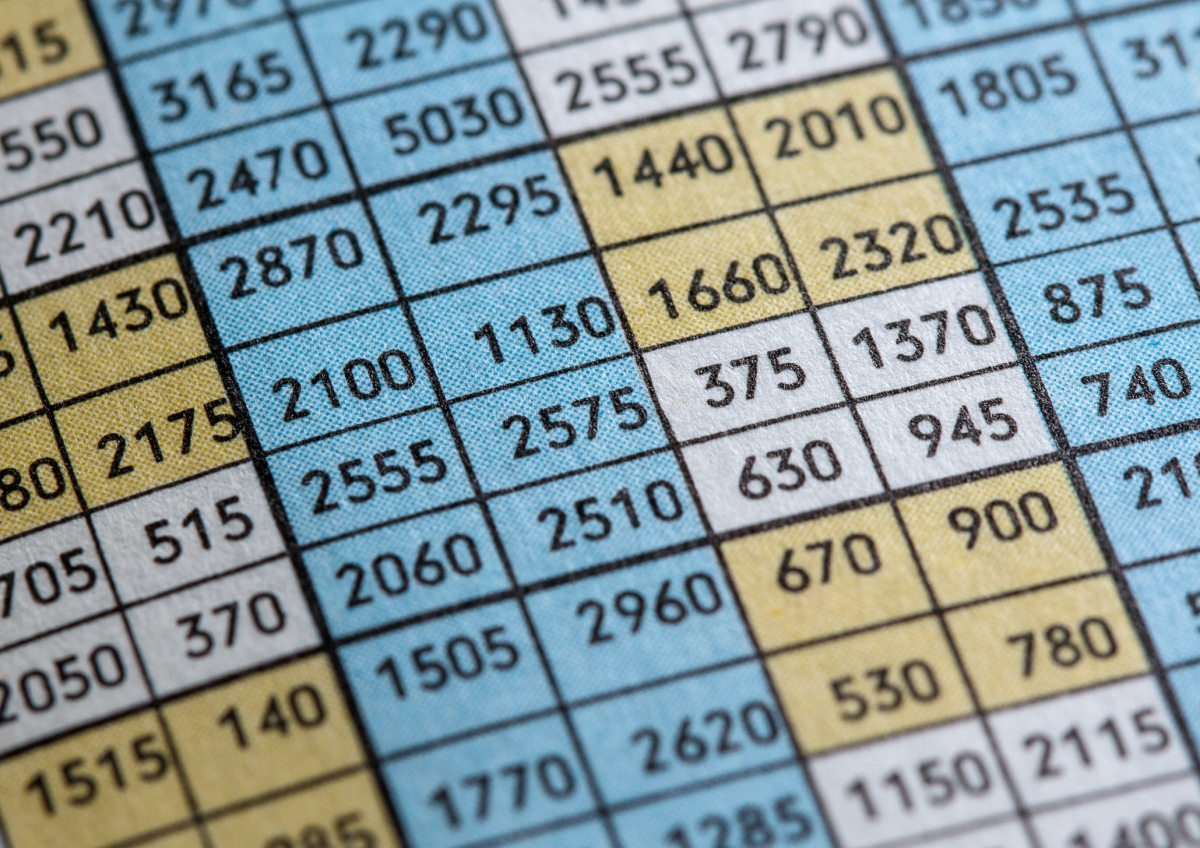

With the explosive adoption of software-as-a-service (SaaS) apps, the average company now has more than 100 SaaS apps to manage — leading to data being siloed across countless different systems. That makes analysis challenging. To wit, according to Forrester, between 60% and 73% of all data within an enterprise goes unused for analytics. Ideally, analysts need something that connects disparate enterprise systems, like business intelligence and analytics tools. But these tools are often complex and unintuitive, leading employees to spend hours each day searching and gathering information. In search of an answer, Navneet Loiwal teamed up with Tommy Tsai, with whom he’d previously founded an e-commerce app, to build Coefficient, an app that brings live data into Google Sheets and other existing spreadsheet platforms. “Tsai and I had worked on consumer technologies for many years, and we saw a big opportunity to bring consumer-grade experiences to companies,” Loiwal told ZebethMedia in an email interview. Loiwal was previously a software developer at Google working on AdWords, while Tsai was an early engineer at location-sharing smartphone app Loopt. “Most data products are designed for the technical user, which results in a poor user experience and low adoption for business users. We wanted to bring the power of technical products to the business user with the simplicity that they expect in their consumer lives.” To this end, Coefficient — which today closed an $18 million Series A funding round — is designed to cut down on the number of manual and repetitive tasks business users have to complete daily to cross-reference data across systems. The platform lays on top of Google Sheets (with support for Excel forthcoming), bringing in data from customer relationship management (CRMs) systems, SQL databases and other SaaS tools. Using Coefficient, users can create, share and automate live reports, set up alerts and write data back to connected SaaS tools. A template gallery provides pre-made spreadsheet dashboards for common reports used by business operations teams (think team KPIs, leadership dashboards and decks and revenue analyses), which users can integrate with existing data systems to enable live data to power all charts within their spreadsheets. Coefficient’s spreadsheet add-on. Image Credits: Coefficient “Business users are more technical in the spreadsheet than anywhere else, yet business teams are often forced to resort to archaic methods of managing data — requesting frequent updates from technical teams with data expertise or exporting raw data from dashboards or CRMs to report repeat, manual analysis, reducing team efficiency and productivity,” Loiwal said. “Coefficient’s products extend the reach of advanced, connected data and analytics to business users, enabling the business to become more self-sufficient through real-time connectivity to the data in their source systems from where they’re working: in spreadsheets.” That’s a lot to promise. And to be sure, Coefficient isn’t the first to attempt this sort of thing. Startups like Airtable and Smartsheet already offer spreadsheet-like UIs to organize business data. Others have tried to put their own spins on the formula, like spreadsheets with apps and spreadsheets with granular access controls. Indeed, at first glance, Coefficient sounds a lot like Actiondesk, which similarly connects with databases, CRMs and SaaS tools to feed live data into Excel and Google Sheets spreadsheets. Like Coefficient, Actiondesk supports common formulas and offers templates for getting started. But to its credit, Coefficient got off to an auspicious start — Loiwal claims that Zendesk, Spotify, Foursquare, Contentful and Miro are among its customers. Combined, tens of thousands of people are currently using the platform. “We are seeing our customers grow their contracts with us despite undergoing layoffs — a testament to the value proposition of making business teams more efficient,” Loiwal said. “Additionally, with increased remote work and complex economic headwinds, companies need their employees to become more self-sufficient.” Loiwal says that the proceeds from the Series A will be put toward expanding Coefficient’s product offerings and “scaling global operations.” In the coming months, the startup plans to add new SaaS system integrations and expand the scope of its reporting automation tools. Battery Ventures led Coefficient’s Series A with participation from Foundation Capital and S28 Capital. To date, the company has raised $24.7 million in capital. Neeraj Agrawal, a general partner at Battery Ventures, added: “It is a testament to the Coefficient team’s product craftsmanship that users become evangelists, promoting use of the product throughout the organization … Coefficient products equip business users with the tools and automation needed to reach peak performance, a critical advantage amid an unpredictable macroeconomic environment.”