Hidden Door wants to turn fiction into immersive roleplaying experiences • ZebethMedia

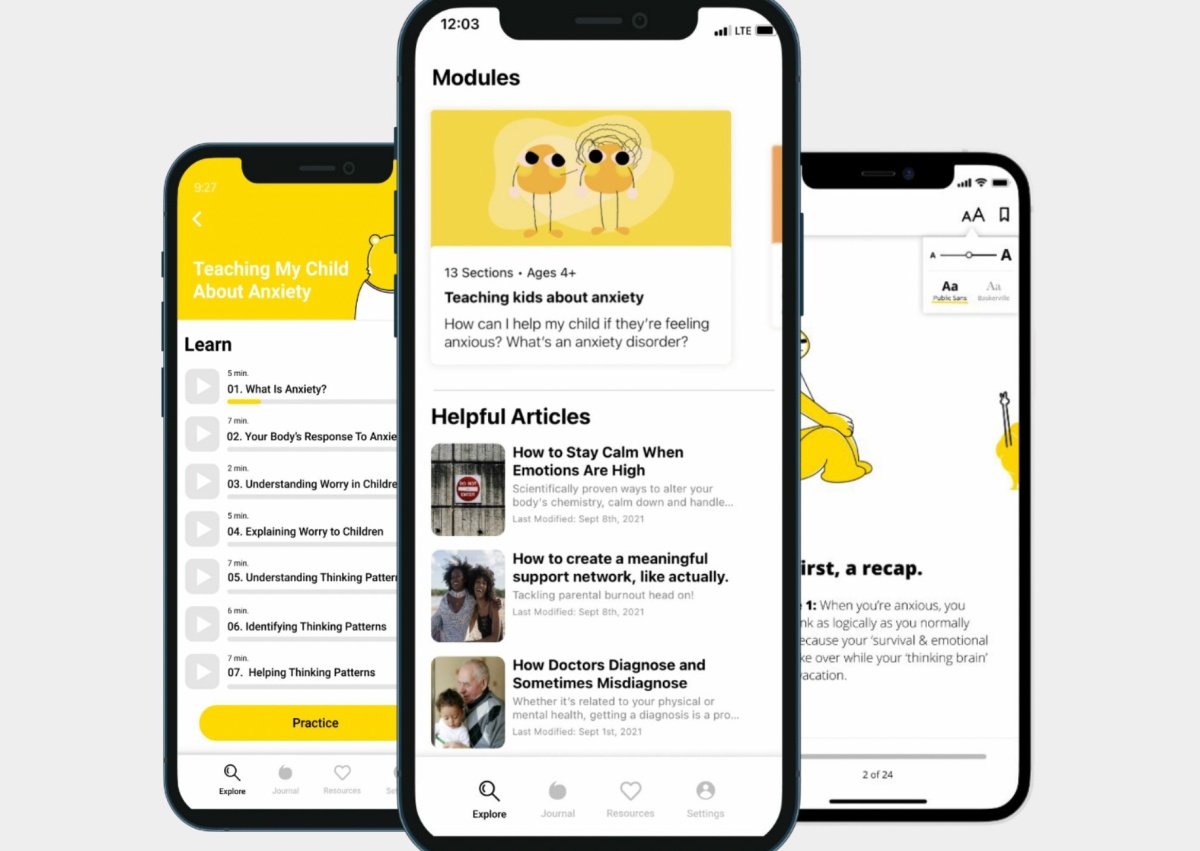

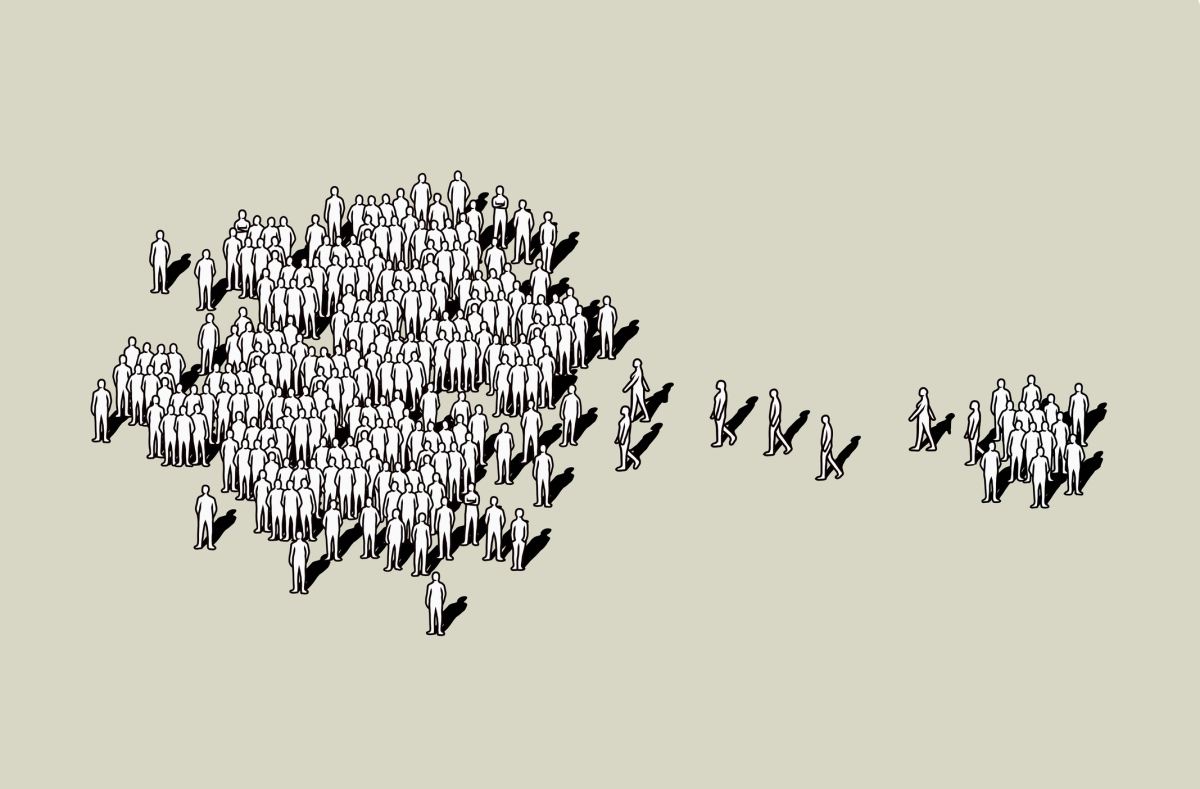

The first season of “House of Dragon” just ended, and I find myself wishing for more. I’ve seen each episode twice already, read through the lore, and even re-watched some “Game of Thrones” episodes. If I had the option to immerse myself in that world and role-play as a dragon-riding Targaryen queen, you bet your ass I would do it. That’s eventually the vision of Hidden Door, a game studio that specializes in narrative AI and competed at ZebethMedia Disrupt’s Startup Battlefield 200 last week. Hidden Door wants to be able to turn any work of fiction into an immersive collaborative roleplaying experience, where players can jump into their favorite story worlds turned into dynamic graphic novels, with text and images being generated based on their choices. Hidden Door is currently testing out an adaptation of “The Wizard of Oz” because the story addresses various age groups and the original text is “so banana pants, which is perfect because it’s supposed to be silly and fun,” Matt Brandwein, Hidden Door’s co-founder, told ZebethMedia. What the platform looks like is a combination of Dungeons & Dragons and Roblox, where you have the vibe of a tabletop roleplaying game that allows you and your friends to “conjure” a story together — only with Hidden Door it doesn’t take four hours to get into character. An in-game AI dungeon master serves as the narrator and builds out a world based on the choices you make as you play. (The above YouTube demo is an early development preview, not the final experience, says Hidden Door.) To set up the game, the players can decide what characters, items, locations, tropes and vibes they want to encounter and “it all comes together like the dynamic back of a book, which doesn’t tell you everything that will happen, but it gives you the sorts of things you will encounter,” said Brandwein. When players choose a character type, the AI dynamically arts that character into a simplistic but cute 2D cartoon avatar. So, for example, a character called “Mischief Maker” might look something like Dennis the Menace in the Land of Oz. Once the character is chosen, the story begins and you’re given a challenge to complete, which you can do in any myriad of different ways based on how you choose to move through the game. The AI creates a host of responsively generated non-player characters, items and locations, which can then be collected, traded and shared with friends to make into new worlds and stories, according to Brandwein. “It’s a trope machine,” said Brandwein about his company’s narrative AI. “It’s trained on 2 million stories in addition to being fine tuned on the author’s work. It knows what sorts of things could plausibly happen, but also what’s implausible. And a lot of the work we’re doing right now is to fine tune it to have the right level of surprise, the right level of subterfuge.” Game studio Latitude last month came out with a similar type of game, AI Dungeon, which writes dialogue and scene descriptions using text-generating AI models. But the company has faced headwinds in both content and image generation. Hidden Door says its AI has the content generation part solved at least, and not only because the model was trained on millions of stories. The more the game is played, the bigger the world gets. Artifacts are created out of that play, which you can share with other players who can mix them into their own stories. Hilary Mason, Hidden Door’s CEO, said the creativity of the players coupled with the machine’s ability to riff off those ideas is a breakthrough on the impossible problem of generative storytelling. The company’s next move is to work with a dozen “fairly well known” sci-fi and fantasy authors who are interested in world building and want to loosely define a world for their fans to inhabit in order to “make this more of a community collaborative entertainment experience,” said Brandwein. “Beyond that, the vision we have for this is that someday, you know, if you’re on Amazon, or something like it, you can read the book, you can listen to the book, and then you might just play the book or whatever it is,” Brandwein continued. “Or if you look at Netflix’s game strategy, it’s some very trivial free-to-play game. But why can’t you put yourself into ‘Bridgerton’ and seduce the dude?” Netflix attempted an immersive TV experience a few years back with “Black Mirror: Bandersnatch” which gave players an option to choose their own adventure. But that was pre-scripted, only giving you an A or a B at every moment, said Brandwein. Hidden Door recently raised a $7 million seed round led by Makers Fund with participation from Northzone and Betaworks. The startup is testing its current product with a cohort of nine to 12 year olds, and is actively looking for authors to collaborate with for future stories, as well as other potential tech partners with an interest in generative AI.