Welcome to the late-stage discount market, where everything is on sale and few folks are buying • ZebethMedia

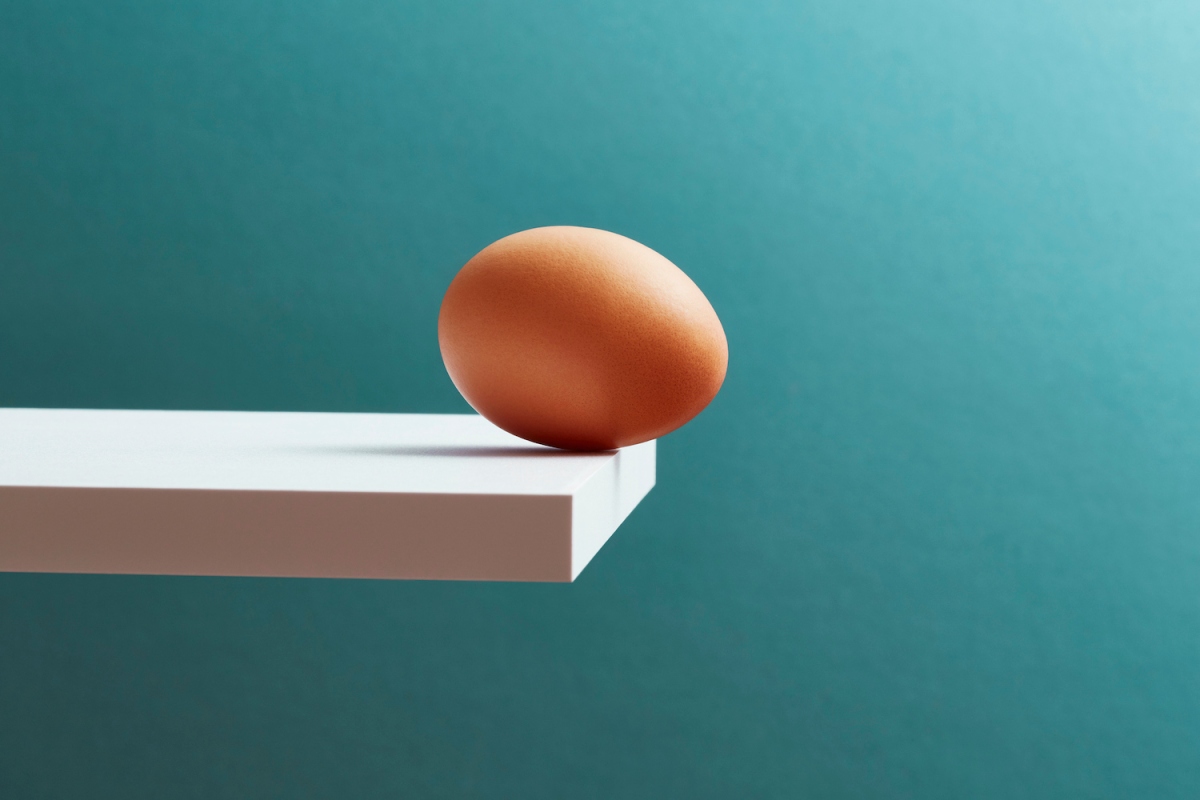

If you are raising money for an early-stage startup today, there’s reason to be hopeful when it comes to the price that you might be able to charge for shares in your company. The later stage your startup is, however, the worse your chances are to raise funds at a price that you like. New data from CB Insights indicates that, on a global basis, the farther along the alphabet a startup’s next funding round is, the more valuation pressure that transaction will be under from a price perspective. The Exchange explores startups, markets and money. Read it every morning on ZebethMedia+ or get The Exchange newsletter every Saturday. The data is surprising in how clear it is in trend terms, but not too surprising. Recall that mega-rounds, or venture capital deals worth $100 million or more, have fallen precipitously this year. While median deal size through the third quarter has been flat in the early- and mid-stage startup market, late-stage deals have gotten smaller this year. With that backdrop, falling late-stage valuations are hardly surprising. Venture investor and SaaS aficionado Jason Lemkin had this to say today: My summary of Venture Markets in Nov 2022: Series B and later even worse than looks in data: 85%+ of investing here has simply ceased[.] Lower volume implies less demand; less demand implies less competition around deal price; less competition means lower prices.