Apple partners with Goldman Sachs to introduce high-yield savings accounts for Apple Card holders • ZebethMedia

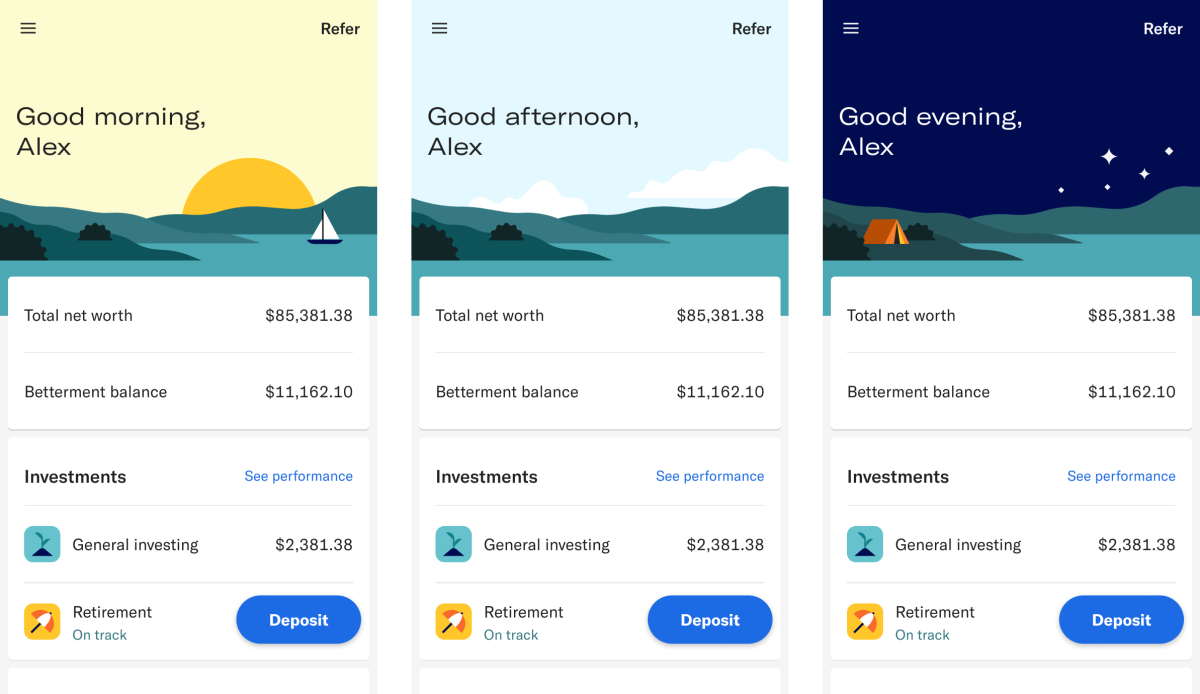

Apple is taking a big step towards offering more banking services to its customers. The company announced today it’s partnering with Goldman Sachs to soon launch a new Savings account feature for its Apple Card credit cardholders which will allow them to save and grow their “Daily Cash” — the cashback rewards that are earned from their Apple Card purchases. In the months ahead, Apple says cardholders will be able to automatically save this cash in a new, high-yield Savings account from partner Goldman Sachs which is accessible with Apple Wallet. Customers will be able to transfer their own money into this account, as well. The account will have no fees, minimum deposits or minimum balance requirements, Apple notes, which would make the account somewhat competitive with a variety of neobanks which are often used as a way for customers to park their digital cash and earn money through interest payments. Apple, in its press release this morning, did not yet say what interest rate would be paid out on these high-yield accounts, however. Currently, competitors are offering APY’s in the range of 2.20%-3.05%, per data from Bankrate. Some are going even higher, Investopedia data indicates, citing APYs topping 3.1% at present. (Apple noted it’s not prepared to announce the APY due to the particularly dynamic interest rate environment at present.) Image Credits: Apple When the new offering launches, Apple Card users will be able to set up and manage their Savings account directly in the existing Apple Wallet mobile app. From that point forward, all the Daily Cash they earn through Apple Card purchases will be automatically deposited into this account, unless customers change this to instead have the cash added to their Apple Cash card in Wallet, as they do today. This option can be switched at any time, Apple says. An in-app Savings dashboard will display the account balance and interest accrued over time. Currently, Apple pays 3% cashback on Apple Card purchases made using Apple Pay at select merchants, including Apple itself, as well as Uber/Uber Eats, Walgreens, Nike, Panera Bread, T-Mobile, ExxonMobil, and Ace Hardware. Apple Card purchases will receive 2% cashback when Apple Pay is used and 1% back when the titanium card is used or when a virtual card number is used to shop online. Cardholders won’t have to rely only on their Apple Card purchases to fund their new Savings accounts, however. Apple says that customers will be able to deposit additional funds through a linked bank account or their Apple Cash balance. They can also withdraw this cash at any time, by transferring it back to that same linked bank account or Apple Cash card, without having to pay fees. With the launch of the Apple Card, Apple has been moving steadily into the payments market, allowing it to establish a more direct connection with its customers as it ramps up its “services” business, which sees it selling subscriptions to a variety of offerings, including Apple Music, Apple TV+, Apple Arcade, iCloud+, Apple News+, Apple Fitness+ and more. It’s also looking to make Apple Pay a more viable option for shopping online, with news that it will introduce an Affirm competitor, Apple Pay Later, for splitting up purchases into four interest-free payments. This offering is delayed until 2023, however, Bloomberg reported. Meanwhile, Goldman Sachs has been moving towards becoming a more conventional bank, with its Marcus by Goldman Sachs product, which announced last year it had reached a milestone of over $100 billion in customer deposits after five years of operation. The partnership with Apple will give it another angle into the consumer deposits market. Apple didn’t offer an exact launch date for its high-yield Savings account, either, saying only it would arrive in the “coming months.” The company said the Savings account feature will ship with an upcoming iOS release, but could not detail which version number will include the option. “Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, in a statement. “Savings delivers even more value to users’ favorite Apple Card benefit — Daily Cash — while offering another easy-to-use tool designed to help users lead healthier financial lives.”