Bilt Rewards’ valuation jumps to $1.5B following new $150M growth round • ZebethMedia

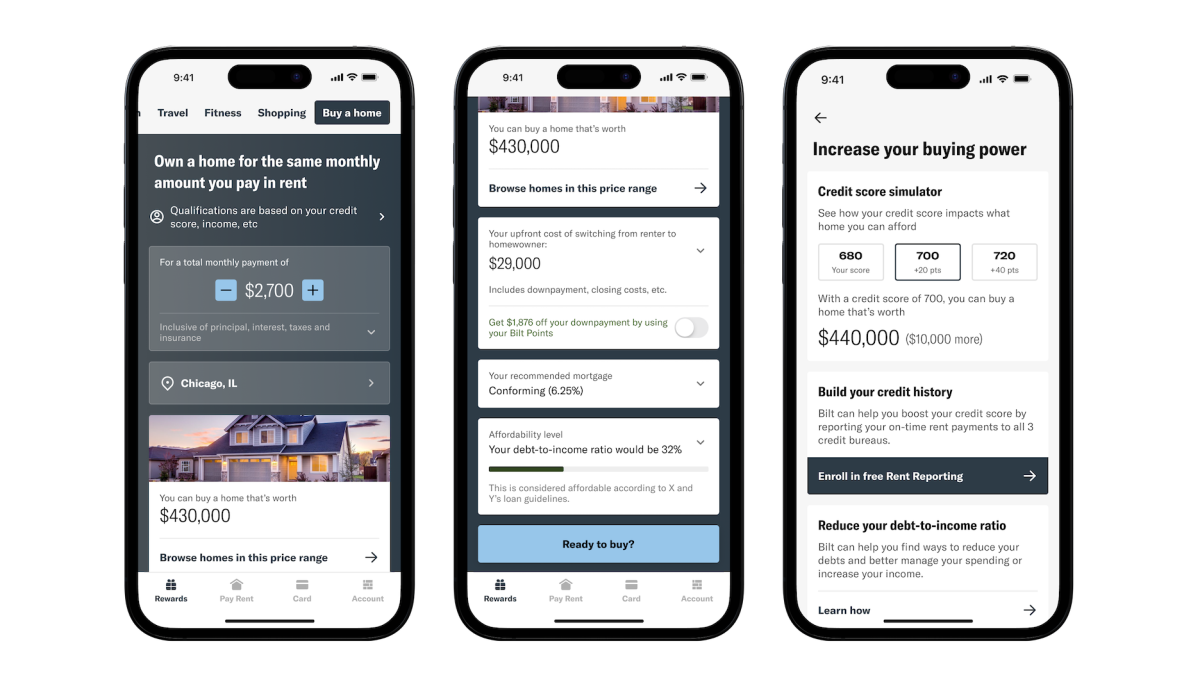

Bilt Rewards, which works with some of the country’s largest multifamily owners and operators to create loyalty programs and a co-branded credit card for property renters, entered unicorn status after securing $150 million in a growth round led by Left Lane Capital. We previously covered Bilt a year ago when the company raised $60 million in growth funding on a $350 million valuation. Today’s investment raises that to $1.5 billion and gives the company about $213 million in total funding since the company launched in June 2021 out of Kairos, the startup studio led by Bilt founder and CEO Ankur Jain. The company’s loyalty program and payment platform was rolled out to more than 2.5 million apartment units across the country so far, Jain told ZebethMedia. Users can earn points and improve their credit by simply paying rent each month. Bilt’s points can be used in 12 loyalty programs, including major airlines, hotels, travel, fitness classes, Amazon.com purchases, credit toward rent or a future downpayment. Bilt has already processed over $3.5 billion in annualized rent payments and over $1.6 billion in annualized card spend to date. Both of those figures are ones that have grown significantly in just the last 90 days, Jain said. Also, there are more than half a million customers using Bilt between the loyalty program and credit card. In addition to the new investment, Bilt also announced a new program called Bilt Homes, which helps renters access homeownership. Here’s how it works: Using the member’s monthly rent payment, Bilt will show the member homes they can own in their area for that same payment. That payment includes real-time interest rates, taxes, income, credit profile and other personal data to determine mortgage qualification, Jain said. Members can also calculate how an improvement in credit rating will affect the mortgage interest rate they may qualify for, and should they need or want it, enroll in Bilt’s free rent reporting to help boost their credit history with every on-time rent payment. “It’s an opportunity for more renters to think about whether homeownership is the right thing for them at this moment in time,” Jain said. “It’s just so stupidly confusing to buy a home today, so we created the first tool where you can now just say, for $3,000 a month, what are the homes that I could buy today for the same amount?” Joining Left Lane in the investment was Wells Fargo, Greystar, Invitation Homes, Camber Creek, Fifth Wall, Smash Capital, Prosus Ventures and Kairos. Previous rounds were more strategic in nature, while this round was the first time Bilt had taken growth institutional capital, Jain said. He notes that the company wasn’t formally looking for new capital. In fact, it had hit profitability earlier this year. However, there was a lot of inbound interest in the company, and bringing on institutional investors like Left Lane Capital positioned Bilt to think more long-term, including a possible initial public offering or other future opportunities, for example, acquisitions. Also, having partners like Wells Fargo double down in this round “was a testament to the strength of the partnership,” as was attracting one of the largest multifamily owners, Greystar, and Invitation Homes, one of the largest single-family rental players, Jain added. Much of the new capital will be kept in reserves for now while the company is focused on aligning interests further with its core commercial partners. “Unlike a lot of the VC rat race businesses where you’re just chasing growth for the sake of chasing growth, we can just keep focusing on the core business and growth and think long-term here,” Jain said. “That’s our goal and a big reason why we raised the capital right now.”