Musixmatch launches a podcast platform for transcription driven by AI and community • ZebethMedia

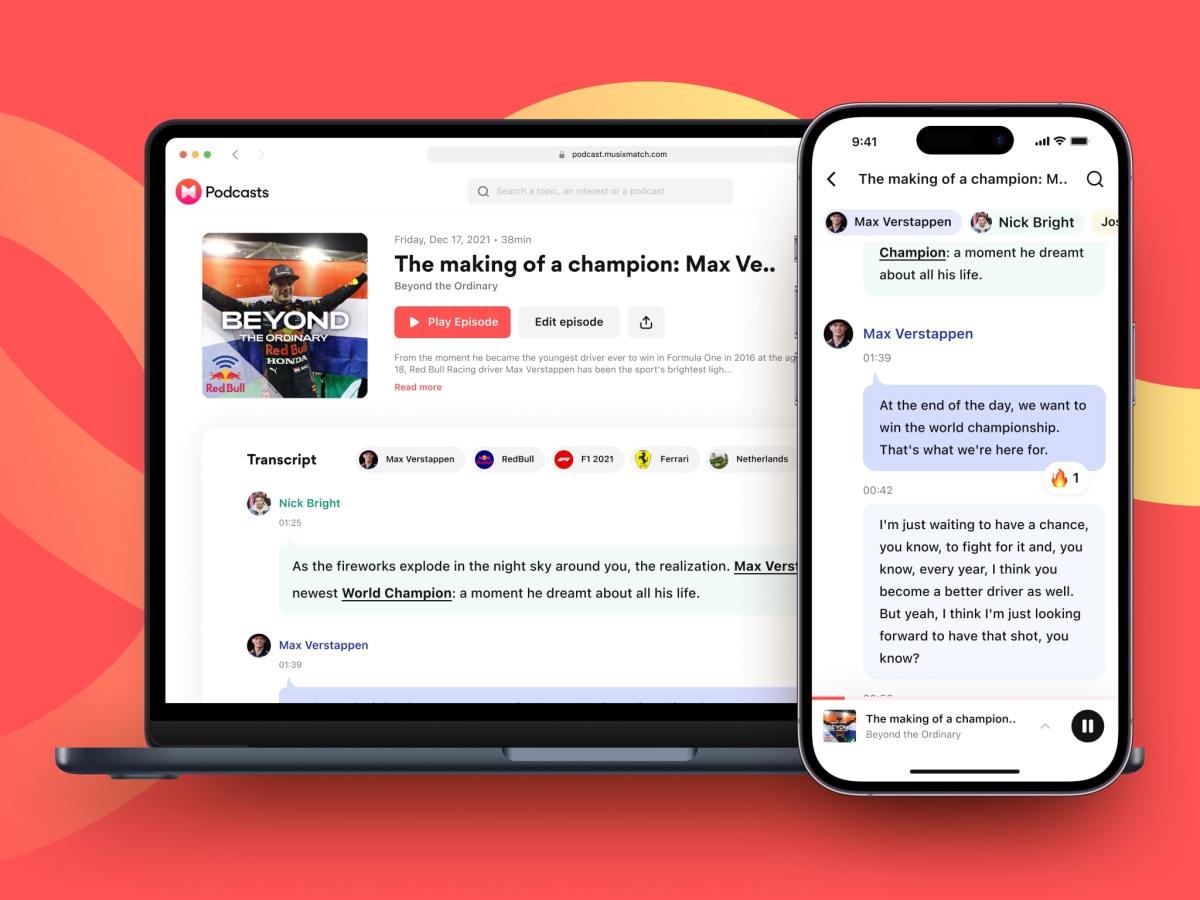

Italy-based company Musixmatch is well-known for providing community-powered lyrics to major music streaming platforms including Spotify, Apple Music, YouTube Music, Amazon Music, and Tidal. Now it’s launching a new platform for podcasts that combines AI-generated transcription and community-verified editing. While there are millions of podcast shows and episodes available for listeners, Musixmatch argues that podcast search is broken. As a result, it suggests a lot of great podcasts don’t get connected to potential fans. So it’s using its experience in training AI models through lyrics and leveraging its NLP (natural language processing) expertise to improve podcast transcription, search, discovery, and sharing. Musixmatch’s podcast platform automatically generates transcription every day for some of the top podcast episodes across different topics and charts. It’s using its NLP base model architecture, Umberto, to tag keywords such as places, people, and topics with Wikipedia IDs — alphanumeric IDs that are linked to topics on Wikipedia. (For instance, this link indicates a Wikipedia ID related to ZebethMedia.) Because of this approach, it says people searching for these topics in any language will get accurate results. The startup explained to ZebethMedia that based on these IDs it creates a topics graph called TopicRank which ranks podcasts based on factors like the number of mentions in an episode or the presenters’ expertise on the topic — enhancing search results for podcasts when users are looking for related topics. Image Credits: Musixmatch “Thanks to this classification, people can finally search for any particular keyword and find transcribed podcasts that match their query, ordered by their relevance. Our search index returns an array of results that is much more detailed and in-depth than any other listening services that rely on standard RSS metadata and predefined genres and categories,” the company claimed. When users search on Musixmatch’s podcast platform, it shows snippets from transcriptions where the searched phrase is mentioned. If they click on the result, the podcast will start playing direct from the timestamp of the snippet that mentions the phrase. That’s pretty neat for when you need to listen to a couple of minutes of audio while researching something. Musixmatch has long relied on its community to make accurate edits to lyrics, and now it’s asking these users to do the same with podcasts. The company’s new podcast portal also includes a tool called Podcast Studio, which allows editors and podcast owners to mend the AI-generated transcription — especially handy for things like people and brand names or cultural references. If there is no transcript for a particular episode the owner or community member can use the Podcast Studio to generate one. Musixmatch says it takes roughly five minutes for AI to generate a transcript for an episode. Regular listeners can also upvote an episode for transcription so the community prioritizes those. Image Credits: Musixmatch It’s important to note that on Musixmatch’s platform AI-generated transcription will have tags such as “Speaker 1” and “Speaker 2,” while Community-edited episodes will have labels with speakers’ names — along with a “verified” label. Human-curated podcast transcription and tags Image Credits: Musixmatch The company is also making sharing easier by displaying cards that have text snippets from the podcast with a shareable link. What’s more, it’s working on a feature called audiograms, which are small sharable videos that include audio and scrolling text snippets from a podcast. Image Credits: Musixmatch Musixmatch doesn’t want to keep all this data to itself. It is allowing podcast owners to export transcriptions to their web feeds and apps. And since these texts are SEO-friendly it argues it will make it easier for listeners to search for them. Some Musixmatch partners it says are using its tools for transcription include “The Talent Show” by The Financial Times; “Beyond the Ordinary” and “Why I Run” by Red Bull; and Chroa Media’s entire production. While Musixmatch’s podcasts platform offer features for listeners, it is not trying to be just a podcast player. The startup argues its competitors are companies that work in the audio analytics space — including apps that provide transcription services (such as Podcastle). “We think that audio analysis (AI, semantic etc) will be a must-have in the near future, for many different use cases. We are in a unique position to provide that service for podcasts because of our AI-powered content analysis tech, our engaged community, and our role within DSPs [demand side platforms], for which we syndicate third-party content already,” the company’s chief product officer, Marco Paglia, told ZebethMedia over email. He added that one of the goals for the company is to become a verified transcription provider for other services — just like its offerings in the lyrics space.