WhatsApp’s new discussion groups offer end-to-end encryption and support up to 1,024 users • ZebethMedia

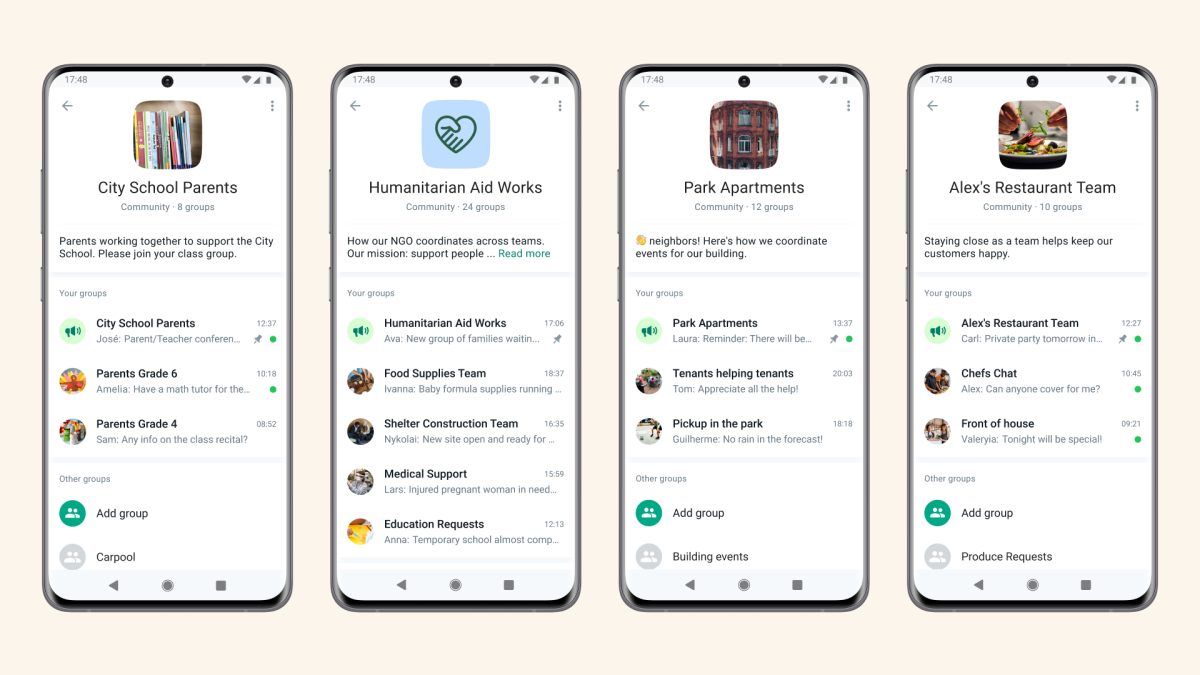

To get a roundup of ZebethMedia’s biggest and most important stories delivered to your inbox every day at 3 p.m. PDT, subscribe here. Oh heeeey! How are you doing today? We’ve had a pretty busy day on the site today, with a veritable cornucopia of news spilling all over the internet. We’ve selected some of the most interesting slices for you below. Enjoy (as far as you can enjoy another day of news about cutbacks and whispered advice to try and panic as little as possible). — Christine and Haje The ZebethMedia Top 3 WhatsUp over at WhatsApp: The messaging giant has been preparing us for this moment since August, and it is finally here: Communities! The new discussion group enables more people to be included and features voice and video calls for up to 32 people, as well as emojis galore, polls and large file sharing, Sarah reports. Might want to switch to polka dots: Stripe cuts 14% of its workforce, and Paul writes that its CEO points to “overhiring for the world we’re in” as having caused the reduction. Unfortunately, it is a layoffs kind of day, so head down to Big Tech Inc. if you can stomach reading more. Where in the world is Ajit Mohan?: Well, the former head of Meta India is now over there at Snap and will serve as the president of the company’s APAC business, Manish and Jagmeet write. Startups and VC “Most designers don’t have real-life manufacturing experience and they are drawing things that aren’t useable by the factory,” Xianfeng Wang, founder and CEO of Pacdora, tells ZebethMedia. To bridge the gap between designers and manufacturers. Wang’s team developed Pacdora, which is like Canva plus Figma for packaging, Rita reports. The platform offers thousands of packaging templates for all kinds of products, from shipping boxes and coffee bags to lotion bottles and yogurt pouches. “I was always looking for that piece of software that could help us do this internally,” Juan Meisel told Christine. He is building a logistics solution with his new startup, Grip. “I started advising some companies on the side. They got their ButcherBox in the mail and were trying to ship anything from frozen milk to chocolate, flowers and pharmaceuticals.” Okay, fine, have another handful of startup news stories: Proptech in Review: 3 investors explain how finance-focused proptech startups can survive the downturn Image Credits: Kuzma (opens in a new window) / Getty Images How are finance-oriented property tech investors reacting to the ongoing downturn in public markets? Senior reporter Mary Ann Azevedo interviewed three VCs to learn more about how they’re counseling the companies in their portfolios, which types of startups are best positioned to weather the downturn, and how they’re managing risk: Pete Flint, general partner, NFX Zach Aarons, co-founder and general partner, MetaProp Nima Wedlake, principal, Thomvest Ventures Three more from the TC+ team: ZebethMedia+ is our membership program that helps founders and startup teams get ahead of the pack. You can sign up here. Use code “DC” for a 15% discount on an annual subscription! Big Tech Inc. Step right up, folks! We know you don’t like carrying around a paper grocery list — heck, we know scrolling on that small phone screen is a nuisance, too. Well, Amazon and Mojo Vision have a treat for you, or rather, your eyeballs. Today, they introduced a proof of concept feature that Brian says is “the first major third-party consumer application on a smart contact lens.” That’s right, an Alexa Shopping List integration for a contact lens that has a computing interface. Layoffs, layoffs as far as the eye can see today. While we already shared the Stripe news with you, and as you’ve likely been hearing for the past week, Elon Musk is also doing some workforce reduction at Twitter. Natasha L reports that he now plans to slash Twitter’s headcount by half. Meanwhile, Kirsten writes that Lyft is laying off 13% of its workforce in an effort to cut operating expenses. And we have five more for you: