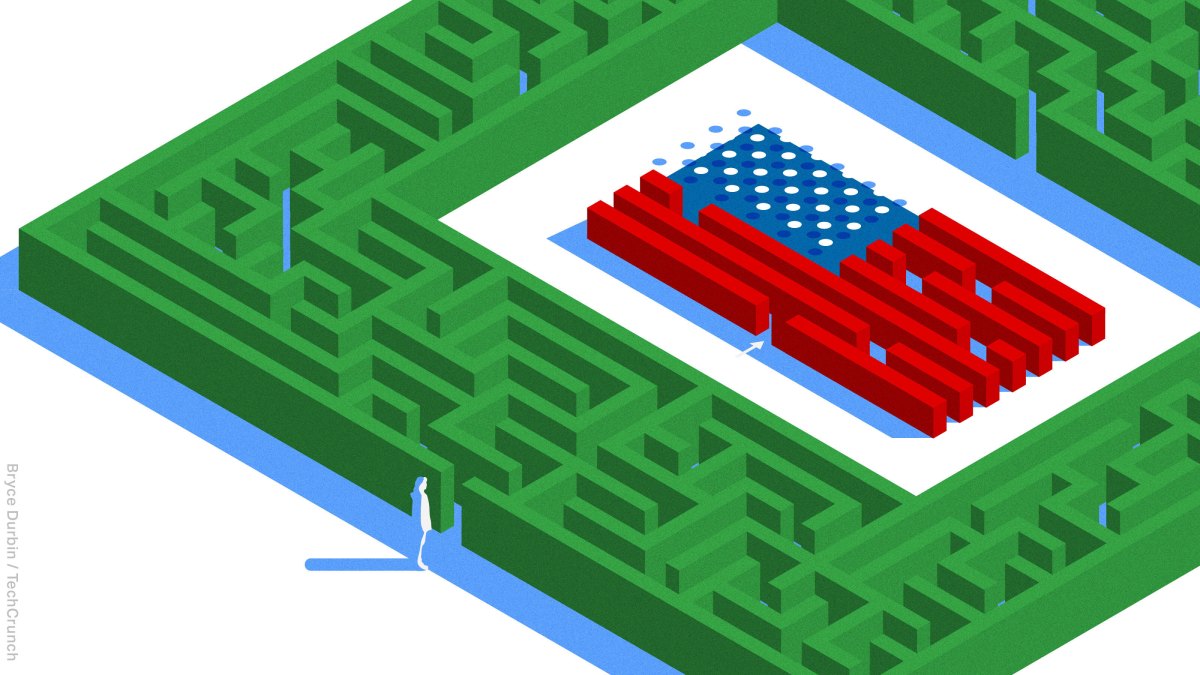

How can I launch a startup while on OPT? • ZebethMedia

Sophie Alcorn Contributor Sophie Alcorn is the founder of Alcorn Immigration Law in Silicon Valley and 2019 Global Law Experts Awards’ “Law Firm of the Year in California for Entrepreneur Immigration Services.” She connects people with the businesses and opportunities that expand their lives. More posts by this contributor Dear Sophie: How can I protect my H-1B and green card if I am laid off? Dear Sophie: Any tips for negotiating visa and green card sponsorship? Here’s another edition of “Dear Sophie,” the advice column that answers immigration-related questions about working at technology companies. “Your questions are vital to the spread of knowledge that allows people all over the world to rise above borders and pursue their dreams,” says Sophie Alcorn, a Silicon Valley immigration attorney. “Whether you’re in people ops, a founder or seeking a job in Silicon Valley, I would love to answer your questions in my next column.” ZebethMedia+ members receive access to weekly “Dear Sophie” columns; use promo code ALCORN to purchase a one- or two-year subscription for 50% off. Dear Sophie, I’m an international student in the U.S. in F-1 status. I will graduate with a bachelor’s degree in computer science this May and plan to apply for OPT. I want to launch a startup. Can I do that with OPT? What options would I have after OPT to continue growing my company? — Forward-Looking Founder Dear Forward-Looking, It’s so exciting to hear you’re planning ahead for your startup founder journey. Taking this route requires planning and forethought. Consult an immigration attorney for guidance as well as precautionary measures to mitigate risks and protect you along the way. Launching a startup on OPT As an F-1 student with OPT work authorization (work permit), you can get your company up and running and be self-employed as long as you’re putting your degree to work. You must also work full time and have all the proper business licenses that your state requires. You don’t have to wait until you get OPT to start setting up your company. Under immigration law, doing things like forming the legal entity for your company, pitching potential investors or negotiating contracts are not considered work, so you are allowed to do them without OPT work authorization. Image Credits: Joanna Buniak / Sophie Alcorn (opens in a new window) That way, once you’re on OPT, you will have a full 12 months to focus on operating your startup. F-1 students can apply for OPT up to 90 days before completing their degree, but no later than 60 days afterward. Take a look at this previous Dear Sophie column on OPT and contact your university’s DSO (designated school official) for more information. If you already know you want to maintain your startup in the U.S. and find investors here, then talk to a corporate attorney to determine how to structure the company. In general, U.S. investors want to deal with Delaware C corporations. Even though you incorporate in the state of Delaware, your startup can be based in Silicon Valley or anywhere in the U.S.